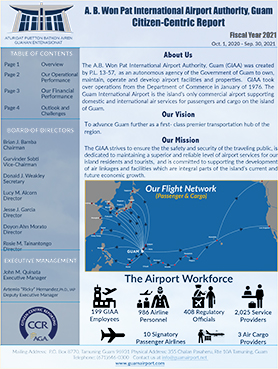

A.B. Won Pat International Airport Authority, Guam

Check Flight Status

Departures

| 06:00 | Manila, Philippines | - | PR111 |

| 07:15 | Osaka Kansai | - | UA151 |

| 07:15 | Honolulu | - | UA200 |

| 07:30 | Nagoya, JP | - | UA137 |

| 08:00 | Saipan | - | UA174 |

Arrivals

| 10:35 | Saipan | - | UA076 |

| 14:40 | Tokyo, JP ~ Narita | - | JL941 |

| 14:45 | Seoul / Incheon | - | LJ913 |

| 15:15 | Seoul / Incheon | - | KE421 |

| 15:45 | Tokyo, JP ~ Narita | - | UA827 |

Guam Airport’s Successful Taxable Refunding Boosted by Investor Confidence in Guam

Tuesday, August 3, 2021

The A.B. Won Pat Guam International Airport Authority (GIAA)—with the support and backing from the Office of the Governor, the Guam Economic Development Authority (GEDA), and the Bureau of Budget and Management Research (BBMR)—will now be able to achieve net present value savings of over $3 million with All in True Interest Cost (TIC) of 4.07%, while reducing FY 2022 debt service payments to $8.1 million—a reduction of $5.6 million—as compared to the prior FY 2021 debt service of $13.7 million. The successful sale of $143 million in taxable refunding bonds was driven by strong investor confidence in the way the GIAA—as well as the government of Guam—has handled the 2019 Novel Coronavirus (COVID-19) pandemic—with the bonds being 18.1x oversubscribed with 9 firms placing orders for the entire series of bonds.

“I want to thank Governor Leon Guerrero, Lieutenant Governor Tenorio, and the Guam Legislature for their approval and authorization to issue these refunding bonds as our airport continues to recover from the impact COVID-19 has had on travel demand,” stated Brian Bamba, Chairman of the GIAA Board of Directors. “Special thanks to our airlines and stakeholders, GIAA management team and GEDA and BBMR leadership for their hard work on this deal.”

Despite the impact of the COVID-19 pandemic, the performance by GIAA was still strong.

“The investor interest in these refunding taxable bonds is evidence of the continued high confidence in Guam’s airport and overall economy,” stated Artemio “Ricky” Hernandez, Ph.D., Deputy Executive Manager of the GIAA. “As we move from COVID-19 response to recovery, the flexibility that comes from restructuring our debt service payments will allow us to navigate through these near-term uncertain times.”

“We are extremely pleased with the results of the GIAA bond sale which arrives on the heels of multiple government bond sales over the last several months to include the BPT and HOT bonds,” stated Governor Lourdes Leon Guerrero. “Being 18.1x oversubscribed is indicative of the overwhelming investor confidence in Guam and is reflective of our people and Administration’s handling of the COVID-19 pandemic and our economic recovery efforts.”

The closing of the bonds is scheduled for the late hours of Tuesday, August 17, 2021.

Sidebar

Latest News

- About Our Airport

- Business Opportunities

- Information for Air Carriers

-

Reports

- Annual Report

- Statistics

- Board Meeting Minutes Audio

- Board Meeting Minutes Print

- Citizen-Centric Report

- Fiscal Year Operating Budget

- Contracts

- Financial Reports

- Rates and Charges

- Grants

- Staffing Pattern

- Statement of Revenues and Expenses

- Performance Evaluations

- Board Quarterly Attendance

- Quarterly Travel

- Non-Employee Travel

- Small Purchases and Construction

- Freedom of Information Act Reports

- Sole Source Procurement - Emergency Procurement

- 14 CFR Part 150 Noise Exposure Map Update

- Programs

- Downloadable Applications

- Media Center

- Employment Opportunities

- Policies, Procedures, Regulations and Plans

Quicklinks

-

-

View our Current Public Solicitation for Services

View our RFPs -

To assist you in planning your departure or arrival at the A. B. WonPat International Airport, Guam, some general information is readily available...

Learn More