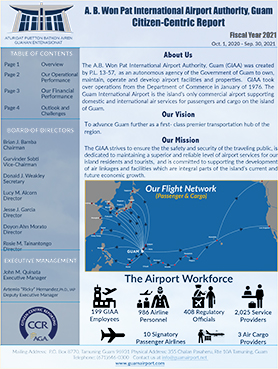

A.B. Won Pat International Airport Authority, Guam

Check Flight Status

Departures

| 13:00 | Tokyo, JP ~ Narita | - | UA864 |

| 15:30 | Seoul / Incheon | - | TW506 |

| 15:55 | Seoul / Incheon | - | LJ914 |

| 16:40 | Tokyo, JP ~ Narita | - | JL942 |

| 17:00 | Seoul / Incheon | - | KE422 |

Arrivals

| 14:30 | Seoul / Incheon | - | TW505 |

| 14:40 | Tokyo, JP ~ Narita | - | JL941 |

| 14:45 | Seoul / Incheon | - | LJ913 |

| 15:15 | Seoul / Incheon | - | KE421 |

| 15:45 | Tokyo, JP ~ Narita | - | UA827 |

Passenger Enplanements at its highest; Revenue Increases by $7.3M

Thursday, January 30, 2014

Results of the FY2013 Financial Statements of the A. B. Won Pat International Airport Authority, Guam (GIAA) were presented and approved by the GIAA Board of Directors at its January 30, 2014 regular meeting. The audit was performed by independent auditors, Ernst & Young, and gave GIAA an unqualified opinion. In addition to the “clean” opinion, there were no findings under the single audit pertaining to GIAA’s federal programs.

Passenger enplanements for FY2013 bordered 1.7 million passengers, the second highest total in GIAA’s history. This is a 7.8% increase over the prior year.

Net income was recorded at $15.1 million as compared to a decrease of $395,000 in FY2012 based on total revenues of $86.7 million. This was a 30.4% increase year on year.

Operating expenses increased by $3.3 million or 9.3% year on year to $38.4 million attributed in part to personnel services with the implementation of a phased employee compensation plan and the reservation of costs for merit bonuses and uniformed personnel. The merit bonuses authorized for prior years are non-recurring.

GIAA maintained a strong Debt Service Coverage Ratio of 2.06, well over the 1.25 ratio required per the Airport’s General Revenue bonds.

The cost per enplaned passenger increased by a modest 2.6% from $16.81 in FY2012 to $17.24 in FY2013 but is budgeted to be reduced to $15.61 for FY2014.

GIAA issued the Series 2013 Airport Bonds in the amount of $247M, of which $110M of bond proceeds for capital improvement projects. The balance was to refund the 2003 bonds and pay for issuance costs. Both Moody’s and Standard & Poor’s rated the bonds as investment grade.

In FY2013, GIAA captured service from Korean Airlines with service from the un-served market of Busan, South Korea. Star Flyer provided twice weekly charter services from Kitakyushu, Japan to Guam and Skymark Airlines provided service with nine charters from Narita, Japan to Guam. Jin Air also introduced a daily night flight that added to the increase in passenger enplanements, and late in the fiscal year, Japan Airlines enhanced the GIAA’s profile with the commencement of cadet pilot training on their B737-800 and B767-300 aircraft.

“FY2013 was a milestone year; with passenger enplanements at an all time high and robust financial activity, stated Charles H. Ada II, Executive Manager. “We’ve turned a corner with healthy net financial results, compared to the decrease in net revenues posted Fiscal Year 2012. We are in a strong position, with a strong and solid debt service coverage ratio of 2.02 versus the 1.25 on our 2003 bonds,” continued Mr. Ada. “In fact, the Airport maintained a debt ratio of over 1.5 for the last four fiscal years. That ratio is a true reflection of our strong fiscal performance.”

“Our focus for FY 2014 is moving forward with our capital improvement projects, constructing our international arrivals corridor for efficient passenger facilitation, a new facility for our Aircraft Fire Fighting Crew, a new cargo apron adjacent to the integrated cargo facility and many other upgrades, improvement and enhancements. We are committed to aggressive marketing to grow our business and will continue to remain financially prudent to safeguard Guam’s most valuable asset,” Mr. Ada concluded.

Sidebar

Latest News

- About Our Airport

- Business Opportunities

- Information for Air Carriers

-

Reports

- Annual Report

- Statistics

- Board Meeting Minutes Audio

- Board Meeting Minutes Print

- Citizen-Centric Report

- Fiscal Year Operating Budget

- Contracts

- Financial Reports

- Rates and Charges

- Grants

- Staffing Pattern

- Statement of Revenues and Expenses

- Performance Evaluations

- Board Quarterly Attendance

- Quarterly Travel

- Non-Employee Travel

- Small Purchases and Construction

- Freedom of Information Act Reports

- Sole Source Procurement - Emergency Procurement

- 14 CFR Part 150 Noise Exposure Map Update

- Programs

- Downloadable Applications

- Media Center

- Employment Opportunities

- Policies, Procedures, Regulations and Plans

Quicklinks

-

-

View our Current Public Solicitation for Services

View our RFPs -

To assist you in planning your departure or arrival at the A. B. WonPat International Airport, Guam, some general information is readily available...

Learn More