A.B. Won Pat International Airport Authority, Guam

Check Flight Status

Departures

| 23:45 | Koror | - | UA157 |

| 01:55 | Seoul / Incheon | - | KE424 |

| 02:30 | Seoul / Incheon | - | LJ918 |

| 03:00 | Busan | - | LJ922 |

| 06:00 | Manila, Philippines | - | PR111 |

Arrivals

| 00:10 | Seoul / Incheon | - | KE423 |

| 01:20 | Seoul / Incheon | - | LJ917 |

| 02:00 | Busan | - | LJ921 |

| 04:20 | Manila, Philippines | - | UA184 |

| 04:20 | Haneda | - | UA848 |

Strong Investor Demand of Guam Airport Bonds Leads to Successful Sale

Wednesday, September 18, 2024

Bolstered by strong investor demand and continued improvement in financial metrics, the A.B. Won Pat International Airport Authority, Guam (GIAA)—supported by the Guam Economic Development Authority and the Bureau of Budget and Management Research—successfully sold $67.8 million in bonds in the municipal market through the first-of-its-kind standalone tender offer for Guam coupled with bond refinancing which resulted in a 4.27% All in True Interest Cost (TIC) and savings of $3.23 million over the remaining term of the bonds through FY 2043.

The GIAA bonds were oversubscribed by 9.3 times, which allowed for an opportunity to lower borrowing rates for higher savings.

“It has been the commitment of our Administration to do all we can to improve the financial viability of not only our government, but also our only commercial airport,” stated Governor Lourdes A. Leon Guerrero. “Our Administration has been at the forefront of achieving debt service reduction and has saved the people of Guam over $124 million over 10 bond issues since we took office.”

Consistent with recent Guam municipal bond issuances, this issue was received with as much enthusiasm by municipal investors due to the GIAA’s strong fundamentals and resilience as it continues to recover to pre-pandemic passenger activity. Investor interest in the GIAA credit was strong and influenced by the recent upgrade of the government of Guam’s General Fund credit rating.

Overall interest rates have declined since their Fall 2023 peak levels and the tender and refinancing structure allowed the GIAA to offer to buy bonds that could not otherwise be refinanced for debt service savings from existing GIAA bond holders and sell refunding bonds to finance the purchase. In the current interest rate environment, municipal issuers have increasingly used tender offers to generate debt service savings.

"We believe investors showed strong interest in this transaction given the continued improvement in GIAA financial metrics as well as progress in our tourism recovery," stated Brian Bamba, Chairman of the GIAA Board of Directors. "Special thanks to the Executive Management team at the GIAA led by Deputy Executive Manager Dr. Artemio “Ricky” Hernandez and Comptroller Dafne Shimizu and to the entire finance team from GEDA and BBMR for their efforts to achieve this extremely positive outcome."

Any further questions or comments should be addressed to Artemio "Ricky" Hernandez, Ph.D., Deputy Executive Manager at (671) 646-0300. Also available to answer questions are BBMR Director Lester Carlson at (671) 475-9318 or GEDA CEO/Administrator Melanie Mendiola at (671) 647-4332.

Sidebar

Latest News

- About Our Airport

- Business Opportunities

- Information for Air Carriers

-

Reports

- Annual Report

- Statistics

- Board Meeting Minutes Audio

- Board Meeting Minutes Print

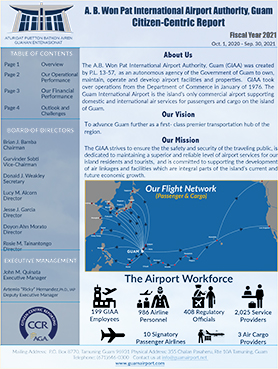

- Citizen-Centric Report

- Fiscal Year Operating Budget

- Contracts

- Financial Reports

- Rates and Charges

- Grants

- Staffing Pattern

- Statement of Revenues and Expenses

- Performance Evaluations

- Board Quarterly Attendance

- Quarterly Travel

- Non-Employee Travel

- Small Purchases and Construction

- Freedom of Information Act Reports

- Sole Source Procurement - Emergency Procurement

- 14 CFR Part 150 Noise Exposure Map Update

- Programs

- Downloadable Applications

- Media Center

- Employment Opportunities

- Policies, Procedures, Regulations and Plans

Quicklinks

-

-

View our Current Public Solicitation for Services

View our RFPs -

To assist you in planning your departure or arrival at the A. B. WonPat International Airport, Guam, some general information is readily available...

Learn More